Strategic Tax Attorneys for Commonwealth Investors & Businesses

Navigating CNMI tax law with proven expertise in Qualifying Certificates, CW-1 matters, and IRS representation

Azarvand Tax Law serves clients throughout the Commonwealth with sophisticated tax law representation, including Qualifying Certificate applications, CW-1 visa tax matters, IRS representation, and comprehensive tax planning. We secured the largest tax abatement granted in CNMI history through the first successful Qualifying Certificate application. We bring advanced tax law credentials, transparent value-based pricing, and understanding of the Commonwealth's unique economic landscape to deliver results for CNMI investors, businesses, and individuals.

Schedule ConsultationWe Don't Just Know Tax Law — We Know What's at Stake

At Azarvand Tax Law, our mission is clear: to be the trusted legal partner in navigating tax law matters with unwavering dedication, expertise, and zealous representation. When you come to us, it's usually not just about numbers or paperwork. It's about your livelihood, your business, your peace of mind, and your future. We understand that tax issues can feel overwhelming, intimidating, and deeply personal. That's why we approach every case with both precision and empathy — whether you're navigating a Qualifying Certificate application, CW-1 visa tax matters, IRS collections and audits, US Tax Court representation, or foreign bank account compliance. We embrace a transparent value-based pricing model, making high-quality legal representation accessible. Our multilingual capabilities ensure language is never a barrier, providing personalized service for clients from all backgrounds throughout the Commonwealth.

Bilingual, Accessible, and Client-Focused

In-house legal services available in:

* Additional languages may be available through Language Line or other interpretation services

Why Choose CNMI Over Puerto Rico

The Commonwealth of the Northern Mariana Islands offers superior tax incentives with community-focused implementation, unlike Puerto Rico's problematic Acts 20/22

The CNMI's Qualifying Certificate program provides tax benefits comparable to—and in many cases exceeding—Puerto Rico's Acts 20/22 (now Act 60), but with a critical difference: the CNMI program emphasizes community benefit and economic development rather than individual wealth relocation. This distinction has resulted in stable implementation without the inflation, displacement, and social tensions that have plagued Puerto Rico's incentive programs.

CNMI Qualifying Certificate

No Property Tax

CNMI has no property tax whatsoever, eliminating a major ongoing expense for real estate investors and business owners

No Sales Tax

CNMI imposes no sales tax, reducing cost of living and business operating expenses compared to Puerto Rico's 11.5% sales tax

Lower Labor Costs

Prevailing wage in many industries is $8.05/hour (federal minimum), significantly lower than Puerto Rico's minimum wage

No FUTA Tax

CNMI businesses are exempt from Federal Unemployment Tax Act (FUTA), providing additional payroll tax savings

Made in USA Benefits

Products manufactured in CNMI qualify for "Made in USA" labeling and tariff-free entry to mainland United States

Community-Focused Program

QC program requires demonstration of community benefit and economic development, ensuring sustainable implementation

100% Tax Abatement Possible

Complete abatement of business gross revenue tax, corporate income tax, and individual income tax available for qualifying investments

Extended Tax Incentive Periods

Tax incentive periods can extend for decades, providing long-term certainty for business planning and investment security

Puerto Rico Acts 20/22 (Act 60)

Property Tax Applies

Puerto Rico imposes property tax, adding significant ongoing costs for real estate holdings

11.5% Sales Tax

High sales tax (IVU) increases cost of living and business expenses, contributing to inflation

Higher Labor Costs

Puerto Rico's minimum wage and prevailing wages substantially higher than CNMI

FUTA Tax Applies

Puerto Rico businesses subject to Federal Unemployment Tax Act, increasing payroll costs

No Tariff Benefits

Puerto Rico products do not receive special tariff treatment beyond standard US territory status

Individual Wealth Focus

Acts 20/22 primarily attracted individual investors seeking tax benefits, with minimal community benefit requirements

No Property Tax Implementation Problems

Program contributed to housing inflation, gentrification, and social tensions as wealthy mainland residents relocated without contributing proportionally to local economy

Displacement Issues

Local residents faced increased housing costs and displacement as program participants drove up real estate prices

Strategic Asia-Pacific Location

CNMI has no property tax whatsoever, eliminating a major ongoing expense for real estate investors and business owners

Stable Political Environment

As a US Commonwealth, CNMI provides political stability, US legal framework, and protection of property rights with the added benefits of local self-governance in economic development matters.

Underutilized Program = Less Competition

Unlike Puerto Rico's saturated tax incentive programs, CNMI's Qualifying Certificate program remains vastly underutilized, meaning less competition for incentives and more attention from CEDA administrators.

Tourism & Real Estate Opportunities

Well-established tourism sector and developing real estate market provide investment opportunities with lower entry costs compared to more established markets like Puerto Rico.

CW-1 Visa Program Access

CNMI's unique CW-1 visa program provides access to foreign workers, addressing labor needs while maintaining competitive wage structures favorable to business operations.

Free Trade Zone Benefits

CNMI Free Trade Zones offer additional incentives including duty-free importation of goods, equipment, and materials for eligible businesses.

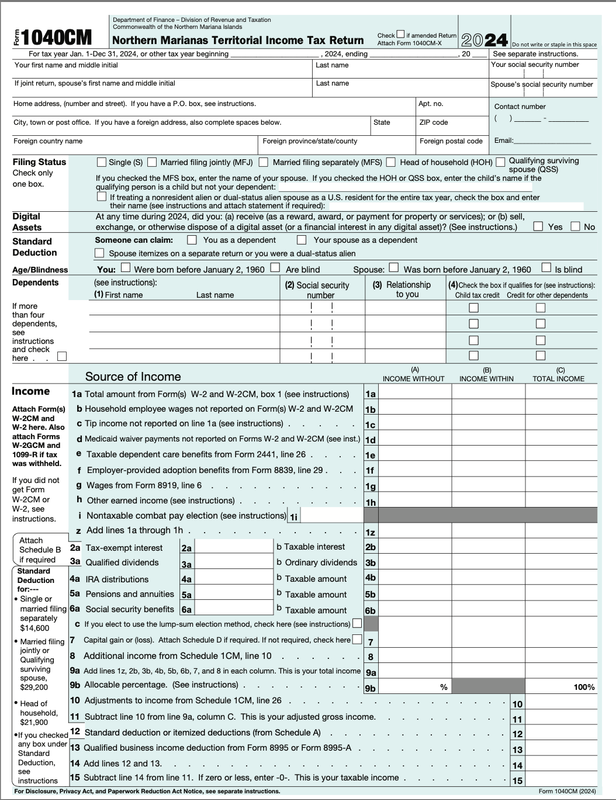

Understanding CNMI Tax Structure

Navigate the "One Return Rule" and the relationship between federal and CNMI taxation

The "One Return Rule"

CNMI follows a unique tax system known as the "One Return Rule" under the Tax Implementation Agreement with the United States:

- CNMI residents file only ONE return with the CNMI Division of Revenue and Taxation

- This single return covers both local CNMI taxes AND federal tax obligations

- CNMI collects and remits federal taxes to the IRS on behalf of residents

- Eliminates dual filing burden present in other US territories

Federal vs. CNMI Income Tax

Understanding the distinction between federal and CNMI taxation is crucial for QC planning:

- Federal Income Tax: Applies to US source income, follows US tax code and rates

- CNMI Income Tax: Mirrors federal rates but applies to CNMI source income

- QC Benefit: Can abate CNMI income tax but NOT federal income tax on US-source income

- Strategic Structuring: Proper entity structuring maximizes CNMI-source income eligible for abatement

Business Gross Revenue Tax (BGRT)

CNMI's primary business tax, distinct from income taxes:

- Graduated tax on gross business revenues (not profit)

- Rates vary by business type and revenue level

- Can be fully abated under Qualifying Certificate

- More predictable than income tax for businesses with thin margins

- No equivalent in Puerto Rico tax structure

Corporate Income Tax Abatement

QC programs can provide complete corporate income tax relief:

- 100% abatement possible on CNMI corporate income tax

- Applies to CNMI-source business income

- Extended duration periods depending on investment

- Combined with BGRT abatement for maximum tax efficiency

Individual Income Tax Considerations

QC benefits can extend to individual shareholders and employees:

- Individual income tax abatement possible for key personnel

- Applies to CNMI-source income

- Particularly valuable for business owners taking distributions

- Requires careful attention to bona fide residency requirements

Strategic Planning Opportunities

Proper structuring maximizes QC tax benefits:

- Entity selection to maximize CNMI-source income characterization

- Transfer pricing considerations for multi-jurisdiction operations

- Intellectual property licensing to shift income to CNMI

- Real estate holding structures for property investors

- Employment arrangements for key personnel to qualify for individual tax benefits

Our Team

Attorneys, CPAs, and professional staff serving the CNMI with sophisticated tax law representation

Tina Azarvand, Esq., LL.M.

Founder & Managing Partner • Tax Attorney

Tina founded Azarvand Tax Law with a commitment to transforming tax legal services through transparent pricing and building lasting client relationships. After multiple visits to the CNMI throughout 2023-2024, she established the firm's CNMI operations in 2024. She serves as Salon Today's Resident Tax Attorney and authors "Tina's Tax Corner" for Marianas Press. She led the firm's landmark MACS Qualifying Certificate application, making legal history as the first firm to secure a QC approval—the largest tax abatement granted in CNMI history.

Recognition & Credentials

- Super Lawyers Rising Stars 2023-2026

- Best Lawyers: Ones to Watch 2023-2026

- Salon Today Resident Tax Attorney

- Marianas Press Columnist (Tina's Tax Corner)

- LL.M. in Taxation, University of Baltimore

- J.D., University of Baltimore School of Law

Candice Miller, Esq.

Partner • Tax Attorney

Candice represents individuals and businesses in tax matters before the IRS and local taxing authorities. Before joining Azarvand Tax Law as a Partner, she practiced as a tax attorney at a Maryland law firm and completed a judicial clerkship with the Court of Special Appeals of Maryland. She graduated in the top 10% of her law school class and received the Dean's Citation Award.

Recognition & Credentials

- Super Lawyers Rising Stars 2024-2026

- Best Lawyers: Ones to Watch 2024-2026

- Dean's Citation Award

- J.D., University of Baltimore (Top 10%)

Craig Siebert, CPA

Certified Public Accountant

Craig is a seasoned Certified Public Accountant with over 35 years of experience in tax, accounting, and start-up business scenarios. Specializing in individual, partnership, corporate, estates, and trusts, Craig's expertise extends to working with start-up clients, offering strategic advice on entity structure and operations. Georgetown University graduate with comprehensive understanding of tax intricacies and practical business applications.

Credentials

- CPA with 35+ years experience

- B.S. Accounting, Georgetown University

- Entity Structure & Operations Specialist

Leticia

Associate Attorney

Leticia provides essential legal support to the firm's tax practice, assisting with client representation, legal research, document preparation, and case management. Her attention to detail and legal acumen ensure efficient handling of complex tax matters and client files.

Charlie Lefebvre, Esq.

Of Counsel • Immigration Attorney

Charlie is the founder of Lefebvre Michel, PLLC, based in Washington, DC. With a diverse background in both business and law, Charlie brings unique expertise to the intersection of tax and immigration law. She focuses on employment-based visas including E, H, J, L, O, TN, and CW-1/CW-2 visas. Before law, Charlie served as a CEO for nearly 10 years, providing invaluable insights into client needs and business strategy.

Expertise

- CW-1/CW-2 Visa Specialist

- Employment-Based Immigration

- Former CEO - 10 years business leadership

Miranda Ma, LL.M.

Attorney • Coming Soon

More information about Miranda Ma will be available soon.

Meet the Rest of Our Team

Lauren Cornell

Paralegal

Kim Esmores

Paralegal

Monica Siebert

Bookkeeper

Kristel Dianne Barnhill

Operations Manager

CNMI Tax Law Services

Comprehensive tax representation for Commonwealth businesses, investors, and individuals

📋

Qualifying Certificate Applications

Strategic representation on CEDA Qualifying Certificate applications, navigating the Investment Incentive Act of 2000, managing the 90-day review process, and securing tax abatements and rebates for CNMI investments. Proven success with landmark MACS QC approval—the largest tax abatement granted in CNMI history.

🌏

CW-1 Visa Tax & Immigration Services

Specialized tax and immigration representation for CW-1 visa holders and their employers, addressing FICA tax obligations, worker classification issues, payroll tax compliance, visa applications, and navigating unique CNMI employment matters. Provided in partnership with immigration counsel Charlie Lefebvre, Esq.

⚖️

IRS Representation

Licensed to practice before the Internal Revenue Service, representing CNMI taxpayers in audits, collections, appeals, offers in compromise, installment agreements, and Tax Court litigation.

🏢

Business Tax Planning

Strategic tax planning for CNMI businesses, including entity selection, Free Trade Zone opportunities, CNMI and federal tax compliance, payroll tax management, and international tax considerations.

👤

Individual Tax Services

Personal tax representation including income tax compliance, estimated tax payments, penalty abatement, tax controversy resolution, and addressing unique tax situations for CNMI residents.

🔍

Tax Controversy & Audits

Defense representation in IRS and CNMI Division of Revenue and Taxation audits, Employee Retention Credit audits, information document requests, and administrative appeals.

💼

Worker Classification

Guidance on employee vs. independent contractor classification, Voluntary Classification Settlement Program (VCSP), and defending against worker misclassification audits.

🌐

Foreign Account Compliance

FBAR and FATCA compliance, foreign bank account reporting, international tax matters, and navigating cross-border tax obligations for CNMI residents and businesses.

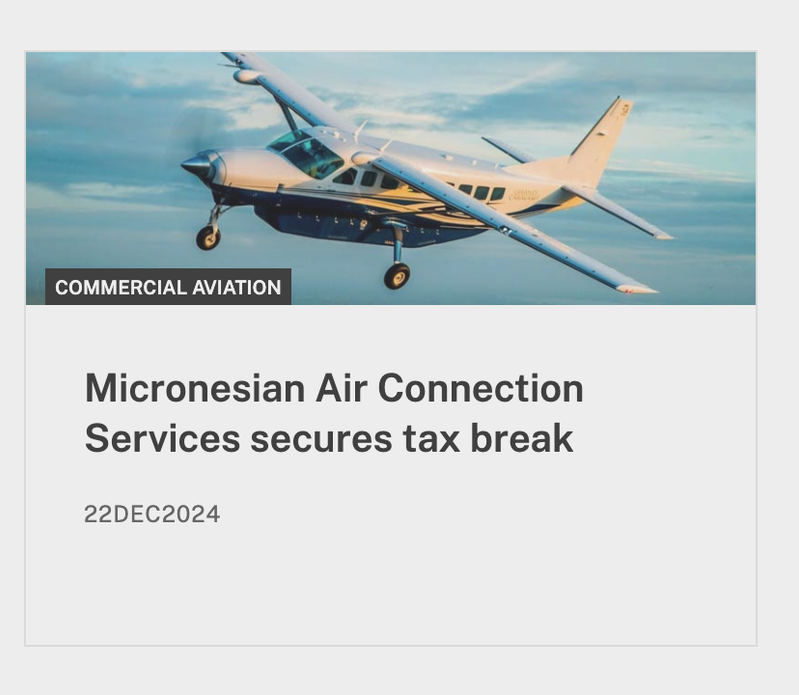

Landmark Achievement

The largest tax abatement granted in CNMI history—making legal history with the first-ever successful Qualifying Certificate

Successfully secured complete tax abatement for 22 years on business gross revenue tax (BGRT), corporate income tax, and individual income tax for Micronesia Air Connection Services—the largest tax abatement granted in CNMI history, enabling new inter-island aviation infrastructure in the Commonwealth.

MACS Qualifying Certificate

- • Client: J&P Holdings (CNMI) LLC / Micronesia Air Connection Services

- • Historic Achievement: One of the largest tax abatement granted in CNMI history

- • Tax Relief Secured: 100% abatement on business gross revenue tax (BGRT), corporate income tax, and individual income tax

- • Duration: 22-year tax abatement period providing long-term certainty

- • Scope: Comprehensive relief covering all primary CNMI tax obligations for the enterprise

- • Impact: Enabled launch of competitive inter-island air service connecting Saipan, Tinian, and Rota

- • Timeline: Application to Governor's approval achieved within CEDA's 90-day statutory requirement

- • Status: CEDA Board approved December 2024, Governor Palacios signed January 2025, service operational April 2025

- • Legal Precedent: First successful Qualifying Certificate application in CNMI history, establishing framework for future applications

In the News

Coverage of our landmark Qualifying Certificate success and CNMI tax matters

June 20, 2024 (Thursday)

UB Law Tax Clinic and Azarvand Tax Law Deliver Assistance to CNMI

The Department of Finance-Division of Revenue and Taxation announced the successful completion of the CNMI Tax Settlement Series, held from June 4-13, 2024, in collaboration with the University of Baltimore School of Law Taxpayer Clinic and Azarvand Tax Law. These organizations provided free assistance to approximately 90 CNMI taxpayers, helping resolve outstanding tax debts.

November 7, 2024 (Thursday)

MACS' Investment Hinges on Tax Exemption

At a public hearing in the Marianas High School cafeteria, Micronesian Air Connection Services outlined plans to bring inter-island transportation services to the CNMI. MACS' tax attorney Tina Azarvand explained the necessity of the qualifying certificate for the airline's viability and sustainability, with benefits extending throughout the CNMI economy.

November 10, 2024 (Sunday)

Delegate-elect King-Hinds Supports MACS' Quest for QC

Delegate-elect Kimberlyn King-Hinds expressed her support for J&P Holdings' qualifying certificate application. According to J&P Holdings tax attorney Tina Azarvand, the certificate would ensure the airline's viability and sustainability, with benefits extending beyond just helping MACS to support the broader CNMI economy.

December 1, 2024 (Sunday)

Tina's Tax Corner: Employee vs. Independent Contractor

In her Marianas Press column "Tina's Tax Corner," Attorney Azarvand addresses the critical business decision of worker classification and the legal consequences of misclassification for CNMI and Guam businesses. The column provides guidance on distinguishing between employees and independent contractors.

December 8, 2024 (Sunday)

CEDA Still Deliberating MACS' QC

The Commonwealth Economic Development Authority is deliberating the qualifying certificate sought by J&P Holdings. According to J&P Holdings tax attorney Tina Azarvand, the certificate would ensure the airline's viability, with her trickle-down economics explanation noting that benefits flow through increased tourism to revitalize the CNMI's COVID-impacted economy.

December 22, 2024 (Sunday)

CEDA Board OKs Tax Relief for Micronesian Air

The Commonwealth Economic Development Authority's board unanimously approved J&P Holdings' request for a qualifying certificate, granting 100% abatement on business gross revenue, corporate income and individual income taxes. The CEDA board's decision required Governor Palacios' approval before taking effect.

December 26, 2024 (Thursday)

MACS Working on Securing Guam Hangar

Micronesian Air Connection Services is working on securing a hangar at Guam International Airport. Should MACS be granted the bid and Governor Palacios officially grant the qualifying certificate, attorney Azarvand stated that CNMI-Guam flights could begin as early as January or February 2025.

January 7, 2025 (Tuesday)

Governor OKs QC for Micronesian Air

Governor Arnold I. Palacios signed the qualifying certificate for Micronesian Air Connection Services. The certificate grants 100% abatement on business gross revenue, corporate income, and individual income taxes—the largest tax abatement granted in CNMI history. J&P Holdings plans to invest in inter-island transportation business under the name Micronesian Air Connection Services.

January 8, 2025 (Wednesday)

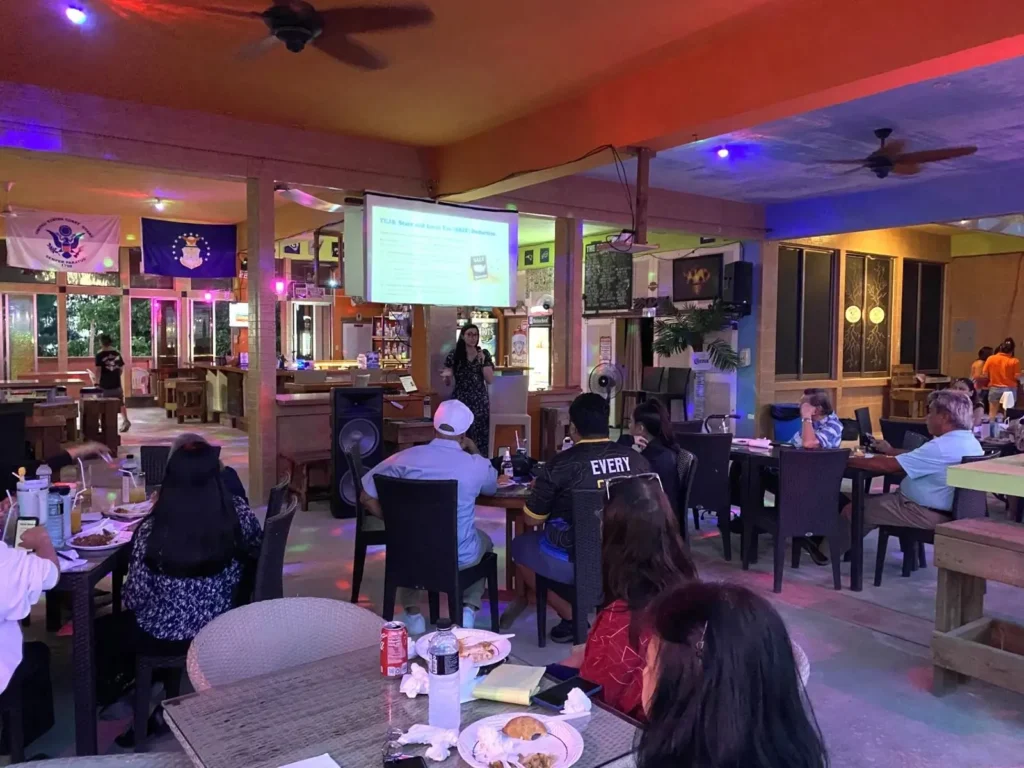

Tax Workshop Addresses Key Issues for CNMI Employers

Tax attorney Tina Azarvand conducted a workshop at Last Shot Bar in Chalan Kanoa discussing FICA tax obligations for CW-1 visa holders, employee vs. independent contractor classification, and upcoming tax developments under the Trump administration affecting CNMI employers and employees.

February 17, 2025 (Monday)

Free Tax & Audit Seminar for CNMI Businesses

The Marianas Business Network hosted an exclusive tax and audit seminar featuring Tina Azarvand, addressing tax preparation, compliance, and controversy for CNMI business owners and financial professionals.

August 11, 2025 (Monday)

The Fight for Fair Tax Treatment in the CNMI

Delegate Kimberlyn King-Hinds published on her official website: "I was grateful to meet with CNMI Tax Attorney Tina Azarvand this week to hear her perspective and share ideas on how we can push for more responsive and equitable tax administration for the Marianas."

September 2024

CNMI Businesses Learn Tax Filing Best Practices

Coverage of Tina Azarvand's workshop highlighting key tax filing practices, quarterly estimated taxes, IRS and CNMI filing rules, and foreign bank account reporting obligations for local businesses.

Schedule Your Consultation

Whether you're considering an investment in the CNMI, seeking Qualifying Certificate representation, navigating CW-1 visa tax matters, or facing an IRS issue, our team provides sophisticated tax law representation. Contact us to discuss how we can support your objectives in the Commonwealth.

Get Started TodayCNMI Operations

Serving the Commonwealth of the Northern Mariana Islands

Saipan, Tinian, and Rota

Additional Locations

Annapolis, Maryland

Silver Spring, Maryland

Washington, D.C.

CONTACT

Email: info@azarvandtaxlaw.com

Phone: (410) 698-4005

Additional Resources

azarvandtaxlaw.com

ercaudittaxattorneys.com

Office Hours

In-house services available in English, Spanish, Chinese, Tagalog, and French

EST (Washington, DC)

- Monday - Thursday

- Friday

- Saturday

- Sunday

JST (Tokyo)

- Monday - Thursday

- Friday

- Saturday

- Sunday - Monday

GMT (London)

- Monday - Thursday

- Friday

- Saturday

- Sunday - Monday

CNMI Tax Attorney | A Practice of

Azarvand Tax Law

The Largest Tax Abatement Granted in CNMI History

Proven Success with Qualifying Certificate Applications

Tina Azarvand, Esq., LL.M. • Candice Miller, Esq. • Craig Siebert, CPA • Charlie Lefebvre, Esq.

© 2025 Azarvand Tax Law. All rights reserved.

The information on this website is for general information purposes only and does not constitute legal advice. Consult with a qualified attorney for advice specific to your situation.v

Azarvand Tax Law

Your tax law partner for CNMI qualifying certificate applications,

federal and territorial tax compliance, and proactive tax planning.

We do not just know tax law.

We understand what is at stake.

At Azarvand Tax Law, our mission is clear: to be the trusted legal partner in navigating tax law matters with unwavering dedication, expertise, and zealous representation. When you come to us, it’s not just about numbers or paperwork. It is about your financial well-being, your business, your peace of mind, and your future.

We understand that tax planning can feel overwhelming, intimidating, and deeply personal. That is why we approach every case with precision and empathy - from navigating Qualifying Certificate applications, CW-1 visa matters, proactive tax planning, or otherwise. We embrace a transparent value-based pricing model, making high-quality legal representation accessible.

Multilingual, Accessible, and Client-Focused

In-house legal services available in:

* Additional languages may be available through Language Line or other interpretation services

CNMI vs. Puerto Rico

Business and Tax Comparison

Tax benefits depend on income sourcing, residency, and structure. Rebates apply only to CNMI-source income. Examples are illustrative and not tax advice.

Why Choose CNMI Over Puerto Rico

The Commonwealth of the Northern Mariana Islands (CNMI) offers a unique combination of U.S. legal protections, tax efficiency, and operational flexibility that differs significantly from Puerto Rico’s Act 60 framework.

Strategic Asia-Pacific Location

CNMI’s location in the Western Pacific provides direct access to Asian markets while operating under U.S. jurisdiction.

- Strategic access to Asia-Pacific trade routes

- Exempt from tariffs under the Jones Act, reducing overall costs

Lower Effective Tax Rates and Labor Costs

CNMI offers a lower-cost operating environment compared to Puerto Rico while remaining under U.S. jurisdiction.

- No local property tax or sales tax; apartments often start around $250–$800/month

- Lower prevailing wages (from $7.25/hr) and reduced overall operating costs compared to Puerto Rico

Underutilized Program = Less Competition

CNMI’s incentive programs remain less saturated than Puerto Rico’s Act 60, giving qualified investors earlier access and greater flexibility.

- Fewer competing applicants for incentives

- More direct engagement with CNMI agencies

CNMI-Only CW-1 Visa and H-1B Visa Exemptions

CNMI offers unique workforce options not available in other U.S. jurisdictions.

- CW-1 visa program allows access to foreign workers for local businesses

- No statutory cap on H-1B visas in CNMI (subject to federal rules)

CNMI Qualifying Certificate vs. Puerto Rico Act 60

Incentives Program Comparison

Tax benefits depend on income sourcing, residency, and structure. Rebates apply only to CNMI-source income. Examples are illustrative and not tax advice.

How CNMI Income Tax Works

A simple guide to filing, sourcing, and how CNMI coordinates with the federal government.

The One Return Rule

(Income Tax Only)

- Bona fide CNMI residents generally only file one income tax return with the CNMI Division of Revenue & Taxation, not the IRS.

- This single return satisfies CNMI income tax and federal income tax on CNMI-source income

- CNMI collects and remits the federal portion to the IRS on your behalf

Important: This applies to income tax only. Payroll forms (e.g., Form 941) and U.S. Self-Employment (e.g., Form 1040-SS) may still be required.

How CNMI Income Tax Works

A simple guide to filing, sourcing, and how CNMI coordinates with the federal government.

The One Return Rule

(Income Tax Only)

- Bona fide CNMI residents generally only file one income tax return with the CNMI Division of Revenue & Taxation, not the IRS.

- This single return satisfies CNMI income tax and federal income tax on CNMI-source income

- CNMI collects and remits the federal portion to the IRS on your behalf

Important: This applies to income tax only. Payroll forms (e.g., Form 941) and U.S. Self-Employment (e.g., Form 1040-SS) may still be required.

Our Team

Meet our Tax Attorneys, CPAs, and professional staff serving the CNMI and beyond with sophisticated tax law representation

Tina Azarvand, Esq., LL.M.

Managing Partner • Tax Attorney

Tina founded Azarvand Tax Law with a commitment to transforming tax legal services through transparent pricing and building lasting client relationships. After multiple visits to the CNMI throughout 2023-2024, she established the firm's CNMI operations in 2024. She serves as Salon Today's Resident Tax Attorney and authors "Tina's Tax Corner" for Marianas Press. She led the firm's landmark MACS Qualifying Certificate application, making legal history as the first firm to secure a QC approval—the largest tax abatement/rebatement granted in CNMI history.

Recognition & Credentials

- Super Lawyers Rising Stars 2023-2026

- Best Lawyers: Ones to Watch 2023-2026

- Salon Today Resident Tax Attorney

- Nominee, Business Person of the Year (Saipan Chamber of Commerce)

Candice Miller, Esq.

Partner • Tax Attorney

Candice represents individuals and businesses in tax matters before the IRS and local taxing authorities. Before joining Azarvand Tax Law as a Partner, she practiced as a tax attorney at a Maryland law firm and completed a judicial clerkship with the Court of Special Appeals of Maryland. She graduated in the top 10% of her law school class and received the Dean's Citation Award.

Recognition & Credentials

- Super Lawyers Rising Stars 2024-2026

- Best Lawyers: Ones to Watch 2024-2026

- Dean's Citation Award

- J.D., University of Baltimore (Top 10%)

Craig Siebert, CPA

Certified Public Accountant

Craig is a seasoned Certified Public Accountant with over 35 years of experience in tax, accounting, and start-up business scenarios. Specializing in individual, partnership, corporate, estates, and trusts, Craig's expertise extends to working with start-up clients, offering strategic advice on entity structure and operations. Georgetown University graduate with comprehensive understanding of tax intricacies and practical business applications.

Recognition & Credentials

- Certified Public Accountant (CPA)

- Nearly 40 years of experience

- B.S. Accounting, Georgetown University

- Entity Structure & Operations Specialist

Leticia Skrabut, Esq.

Associate Attorney • Tax Attorney

Leticia provides essential legal support to the firm's tax practice, assisting with client representation, legal research, document preparation, and case management. Her attention to detail and legal acumen ensure efficient handling of complex tax matters and client files.

Expertise

- Tax Law Practice & Compliance

- Law Clerk Experience in Tax Law Firms

- Bilingual Legal Services (Spanish & English)

Charlie Lefebvre, Esq.

Of Counsel • Immigration Attorney

With a diverse background in both business and law, Charlie brings unique expertise to the intersection of tax and immigration law. She focuses on employment-based visas including E, H, J, L, O, TN, and CW-1/CW-2 visas. Before law, Charlie served as a CEO for nearly 10 years, providing invaluable insights into client needs and business strategy.

Expertise

- CW-1/CW-2 Visa Specialist

- Employment-Based Immigration

- Multilingual (Spanish, English, French)

Miranda Ma, LL.M.

Law Clerk

Miranda Ma is a Law Clerk with Azarvand Tax Law who brings exceptional academic credentials and bilingual capabilities to serve clients with domestic and international tax matters. Sitting for the Bar Exam in 2026, Miranda graduated with her Master of Laws in Taxation, earning a 3.7/4.0 GPA, from Georgetown University.

Expertise

- Dean's List with Distinction as a Merit Scholarship Recipient.

- CALI Excellence Award Recipient

- Bilingual (Chinese, English)

Meet the Rest of Our Team

CNMI Tax Law Services

Qualifying Certificate Applications

CW-1 Visa & Immigration Services

IRS Representation

Business Tax Planning and Preparation Services

Employee Retention Credit (ERC) Audit Services

Tax Controversy & Audits

Worker Classification

Foreign Account Compliance

In The News

22-Year Approval · QC Program

MACS Qualifying Certificate

- • Historic Achievement: Successfully secured 22-year 100% tax abatement of all individual and corporate income tax and BGRT. Enabling the launch of new inter-island passenger airline serving the CNMI and Guam.

August 11, 2025 (Monday)

The Fight for Fair Tax Treatment in the CNMI

Delegate Kimberlyn King-Hinds published on her official website: "I was grateful to meet with CNMI Tax Attorney Tina Azarvand this week to hear her perspective and share ideas on how we can push for more responsive and equitable tax administration for the Marianas."

January 8, 2025 (Wednesday)

Tax Workshop Addresses Key Issues for CNMI Employers

Tax attorney, Tina Azarvand, conducted a workshop at Last Shot Bar in Chalan Kanoa discussing FICA tax obligations for CW-1 visa holders, employee vs. independent contractor classification, and upcoming tax developments under the Trump administration affecting CNMI employers and employees.

January 7, 2025 (Tuesday)

Governor OKs QC for Micronesian Air Connection Services (MACS)

Governor Arnold I. Palacios signed the qualifying certificate for Micronesian Air Connection Services. The certificate grants 100% abate/rebatement on business gross revenue, corporate income, and individual income taxes—the largest tax abate/rebatement granted in CNMI history. J&P Holdings plans to invest in inter-island transportation business under the name Micronesian Air Connection Services.

January 16, 2026 (Friday)

Azarvand Earns Business Person of the Year Nomination

Tina Azarvand was nominated for the Saipan Chamber of Commerce’s Business Person of the Year Award, recognizing her leadership, community involvement, and contributions to the local business environment in Saipan.

January 16, 2026 (Friday)

Azarvand and Miller Named 2026 Super Lawyers Rising Stars

Tina Azarvand and Candice Miller were selected to the 2026 Super Lawyers Rising Stars list, a distinction awarded to a limited number of attorneys recognized for professional achievement and peer recognition.

June 20, 2024 (Thursday)

UB Law Tax Clinic and Azarvand Tax Law Deliver Assistance to CNMI

The Department of Finance-Division of Revenue and Taxation announced the successful completion of the CNMI Tax Settlement Series, held from June 4-13, 2024, in collaboration with the University of Baltimore School of Law Taxpayer Clinic and Azarvand Tax Law. These organizations provided free assistance to approximately 90 CNMI taxpayers, helping resolve outstanding tax debts.

Schedule Your Consultation

We provide focused and sophisticated tax law representation in connection with CNMI investments, Qualifying Certificate matters, and IRS proceedings.

Contact us to discuss how we can support your objectives in the Commonwealth.

CONTACT

Email: info@azarvandtaxlaw.com

Phone: (888) 572-6829 (Call and SMS)

Additional Resources

azarvandtaxlaw.com

ercaudittaxattorneys.com

Office Hours

In-house services available in English, Spanish, Chinese, Tagalog, and French

Open 24/7

Just give us a call 24/7 on the numbers below:

(888) 572-6829 (Call and SMS)

CNMI Tax Attorney | A DBA of

Azarvand and Associates

(888) 572-6829 (Call and SMS) | info@azarvandtaxlaw.com | Northern Mariana Islands | Maryland | Washington D.C.

© 2025 Azarvand Tax Law. All rights reserved. |

Privacy PolicyThe information on this website is for general information purposes only and does not constitute legal advice. Consult with a qualified attorney for advice specific to your situation.